Tall alterations in your financial situation, particularly work losses or highest instructions, could affect one last loan acceptance

Brand new In depth Nature off Pre-acceptance

Having established the basic construction regarding what pre-acceptance requires, it is critical to delve into the detail by detail character and just why they is actually a extreme connection regarding home loan application processes than pre-certification.

- Thorough Credit check : In the place of pre-qualification, pre-approval involves a painful query to your credit history. Lenders commonly closely examine your credit rating, credit rating, and one points that might impact the loan qualification.

- Verification out-of Financial Information : During pre-recognition, the financial institution verifies your financial guidance, including your income, employment position, assets, and you will current expense. This step is extremely important when you look at the determining the actual loan amount your are able as well as the interest levels applicable.

Pre-approval: Good Conditional Financial Partnership

An effective pre-approval letter can often be named an eco-friendly light to have a great mortgage, however it is vital that you understand it is a great conditional relationship. The final acceptance try susceptible to certain criteria, particularly an appropriate assets assessment without high alterations in your debts.

Pre-acceptance emails routinely have a quality several months, usually sixty so you’re able to 90 days. This time around figure gives you a definite windows discover a great domestic making an offer on the promise that your financing is actually tentatively secured.

Just how Pre-acceptance Advantages Your Homebuying Journey

- Negotiating Fuel : Which have a great pre-recognition letter available, you’re in a stronger reputation so you can negotiate that have sellers. They reveals you’ve got the support of a lender and generally are prepared to stick to the purchase.

- Delicate Household Look : Knowing simply how much you might acquire assists restrict the domestic search in order to functions lined up with your finances, and make your search more beneficial.

Preparing for Prospective Pressures

The latest intricate borrowing feedback throughout the pre-recognition normally let you know problems that can impact the loan terms and conditions otherwise power to become approved, getting an opportunity to address these issues prior to signing a property get.

Knowing the outlined nature from pre-recognition describes why payday loan Midland it’s a significant part of the loan processes. It is more than simply an advanced variety of pre-qualification; it is an extensive evaluation one to set the tone to suit your entire homebuying sense. By putting on pre-recognition, you updates on your own just like the a significant visitors, armed with a clear comprehension of your financial possibilities and you can limitations.

Secret Differences when considering Pre-certification and you may Pre-acceptance

Understanding the distinction between pre-approval and you will pre-qualification isn’t only in the understanding the meanings; it’s about gripping exactly how for each phase affects your approach to to find a house.

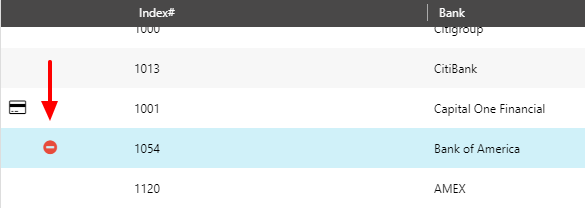

So, to add an obvious knowledge of how pre-certification and pre-recognition disagree, we have found a fast testing reflecting the trick properties:

As to why the brand new Improvement Issues

Understanding the difference between pre-certification and you may pre-acceptance is over a straightforward educational do it; it has got fundamental ramifications for the homebuying journey. Which distinction is essential for some factors, each affecting how you means the purchase in your home.

Form Sensible Expectations to possess Economic Thought

The homebuying journey begins with pre-certification, getting a young imagine of one’s borrowing potential. This support place a basic cover your home search. But not, this is the pre-approval which provides a right and you can reliable indication of the monetary capabilities.

Accepting this variation is vital having planning your earnings and you may house lookup based on verified advice instead of just quotes. They guarantees your financial believe is rooted into the reality, preparing your to your real can cost you and you may responsibilities of purchasing a great household.

Improving Trustworthiness throughout the Housing market

With respect to getting together with providers and realtors, a great pre-recognition page somewhat elevates the standing. Instead of a pre-certification, an excellent pre-approval suggests you have gone through a strict financial vetting procedure and they are a critical visitors, willing to go-ahead having a buy.