Take note, at the time of composing, the average interest rate to have a mortgage is hanging around 7%

When it comes to to buy a moment home, one of the most tactics to understand ‘s the attract rate you will be spending on your own mortgage. Interest levels to possess 2nd land, that are qualities you wish to invade including the first residence to possess an element of the 12 months or funding motives, are usually greater than people to own no. 1 homes, while the loan providers view them once the riskier expenditures.

On this page, we are going to diving to your present state of interest cost having second property, elements one to determine such prices, and you can all you have to learn prior to purchasing the second assets.

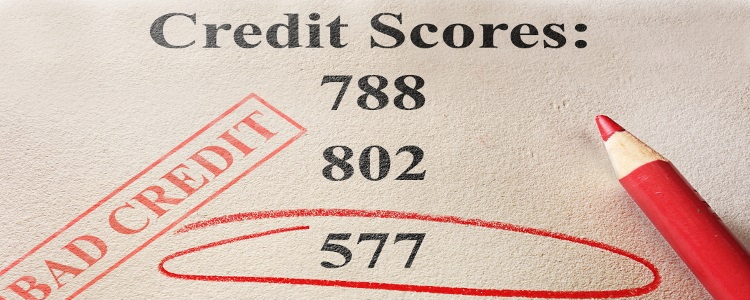

Yet not, so it price try subject to alter and you will be determined according to a good amount of products as well as your credit score, the mortgage-to-well worth ratio, and also the location of the assets.

What truly matters since the the second Home?

An additional family, commonly known as a secondary family, is a house you own besides much of your household. Its a dwelling for which you purchase area of the season, determining it out of your head life style quarters. The borrowed funds obtained to finance that it purchase is known as the second home loan.

Studies about Federal Organization out of Domestic Builders found there are eight.fifteen million second belongings about You.S. inside the 2020, creating 5.11% of your own full property stock. Subsequently, such as for example dependent on the latest pandemic, there has been a significant upsurge in trips household sales into the aforementioned 1 / 2 of 2020 and you can to the early 2021, showing a change when you look at the lifestyle and you may performs figure.

- It needs to be an individual-home.

- It ought to be habitable all year long, just to have regular occupancy.

- You are likely to alive there to have a certain several months per year.

- The fresh control need offer your personal power over the home, and therefore excludes timeshares otherwise qualities beneath the management of property management enterprises.

- The property can’t be rented aside complete-date, nor would you trust leasing money so you can services the loan.

This type of requirements make sure the possessions really functions as your own retreat as opposed to a rental investment, identifying next property on the economic landscaping.

Investment Family against. Second Domestic

An investment property allows you to speak about the field of genuine house financial support, targeting a lot of time-term monetary progress through leasing income. Rather than a second home, an investment property isnt an area for which you manage generally speaking spend vacations otherwise alive area-time; its purely to possess income generation or capital fancy.

In case your mission which have property is to try to secure local rental income, lenders usually categorize it a residential property, impacting the mortgage terms. Financial support properties tend to call for a much bigger down-payment than 2nd house because of the observed higher risk by loan providers.

For this reason, when you’re deliberating between to invest in your own sanctuary or making a keen financing, an investment property merchandise a path to include one another objectives, marrying the very thought of a property ownership that have financing.

Number one House

Much of your residence is more than just an address; it’s in which yourself spread for the majority of the entire year. They really stands in contrast to funding characteristics, since it functions as your personal liveable space in place of a beneficial supply of rental earnings. The brand new emotional worth of an initial residence often is preferable to their resource potential.

But not, when you are considering transitioning the majority of your house into an investment property cash loans in Macclenny to utilize potential local rental money, its important to navigate so it change cautiously. This consists of getting agree from your own mortgage lender to get rid of violating the latest regards to your loan and you will consulting with a tax coach to know the brand new implications, like potential alterations in their tax liabilities and you may experts. This preparing ensures you may be really-told about the monetary and legal aspects of such a sales, protecting your own passions and you will optimizing the property’s really worth.