Bringing that loan With no employment: Tips and you may Info

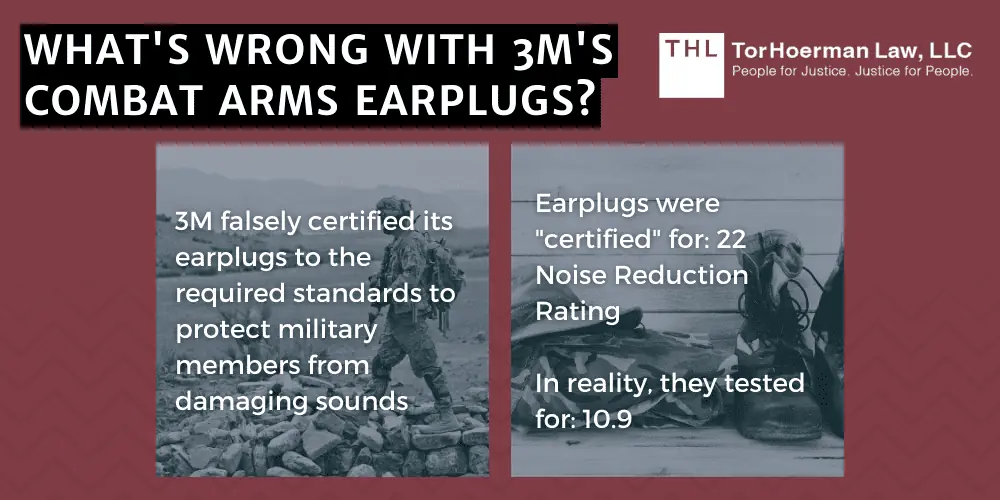

You’ll be able to shell out high interest rates or origination costs if lenders view you as a riskier borrower with no employment. Holger Scheibe/Getty Photos

- Introduction

- Understanding mortgage eligibility

- Form of financing to adopt

- Additional savings

- Navigating the program techniques

Associate backlinks toward facts in this post come from lovers you to definitely compensate all of us (discover our marketer revelation with your range of lovers to get more details). not, all of our viewpoints try our very own. See how we rate unsecured loans to type objective recommendations.

- Particular loan providers enable you to get a loan with no employment, in the event you’ll likely require some sorts of money.

- See your very own loan’s interest rate, label duration, and you will charge in advance of recognizing the conditions.

- In lieu of taking right out a loan, you could query friends to own let otherwise dip into the your discounts.

How loan providers check loan requests

Lenders examine of a lot activities in terms of your application, and additionally credit rating, payment history, debt-to-money proportion, as well as your yearly earnings. While this may seem disconcerting while unemployment, of many lenders are able to envision most other resources of money. This may were alimony, handicap money, pensions, plus.

You’ll be able to be able to find a choice source of money off a side gig, rating a cosigner, or bring equity to increase your odds of getting acknowledged.

You may need to spend highest rates of interest otherwise origination costs as loan providers view you as the a riskier borrower without a job.

“Without having a career, taking out that loan is something that you should end while the very much like possible by the possibility of overlooked otherwise later payments and you will a leading interest rate,” states Forrest McCall, individual fund expert and you can maker out-of PassiveIncomeFreak. “In the event you pull out financing, make sure to grasp new terms of the americash loans Moody loan, in order to repay it versus accumulating high desire fees.”

Secured personal loans

You are good able to find financing without verifying your income for people who promise collateral such a motor vehicle otherwise other possessions your lender can take or even pay back your debt. This is known as a guaranteed mortgage.

What to anticipate

When deciding whether to sign up for that loan or not, Andrew Latham, a certified Monetary Planner together with controlling publisher out of SuperMoney, says you ought to mostly think about the reason for the borrowed funds and you may whether you will have the amount of money to settle it. It’s less extremely important in the event you otherwise do not have an excellent occupations.

“Bringing that loan with no employment shall be a sensible move when you are committing to the training or carrying out a business,” Latham says. “It’s possible to get financially responsible and just have an effective personal loan without a job providing you keeps an enthusiastic solution revenue stream, such notice and you can dividends, public security, long-identity disability, alimony, or a retirement.”

If you are obtaining that loan with no employment, lenders get thought various offer due to the fact solution earnings, instance leasing income, alimony, youngster help, retirement benefits, otherwise financial support returns.

Certain loan providers could possibly get thought unemployment advantages because the temporary income, however, that it tend to hinges on the new lender’s principles and the balance of your own other monetary factors.

A robust credit rating may be very important when you lack conventional employment as they are making an application for a loan. It reassures lenders of your creditworthiness and capability to repay the newest loan.

Secured finance is financing that want guarantee, like a car or truck or household. It reduces the lender’s risk and may help you get a loan as opposed to antique a job.

Sure, good co-signer that have steady earnings and you can a good credit score can alter your financing application’s power by providing a lot more assurance into the bank.