BenefitsLink Fitness & Hobbies Plans Newsletter to possess December cuatro, 2025

Posts

Not one approach is useful for all as the, one of additional factors, folks have other financial desires, various other time horizons to have fulfilling its desires, and different tolerances to possess exposure.It is extremely vital that you occasionally opinion forget the collection, your investment expectations, plus the financing possibilities within the Intend to help ensure that pension discounts can meet retirement wants. Whether or not diversity is not a vow facing loss, it’s a good solution to help you do funding exposure.Inside the choosing tips dedicate retirement savings, you need to make up all of your assets, in addition to one old age discounts outside of the Plan. For those who purchase over 20% of the retirement savings in any one to company or globe, the deals might not be safely diversified. Because the noted, this type of requirements work to have package ages delivery just after December 29, 2006. However the law will not give particular guidance for electronic delivery.

DOL Tips on Pension Benefit Comments

Most personal company old age preparations are influenced and covered by afederal your retirement laws known as the Staff Senior years Earnings Protection Operate out of 1974 ("ERISA"). Ensure your employee pros preparations remain certified having ftwilliam.com, EnsuredCompliance®. Before the new PPA, some agreements willingly given employer inventory diversification legal rights which might be equal so you can, and in some cases better than, those people necessary for ERISA § 204(j). The new PPA and amends ERISA § 204(j) to require laid out contribution plans to enable professionals to divest people company inventory holdings due to employer benefits after completing three-years away from solution. DC agreements have to offer Comments to professionals and beneficiaries who’ll direct assets to your a every quarter basis. Therefore, participant-led DC preparations are required to give its earliest Comments for the one-fourth ending March 29, 2007 if they’re twelve months agreements.

Wolters Kluwer's ftwilliam.com Launches The brand new Function 5330 age-Filing Features

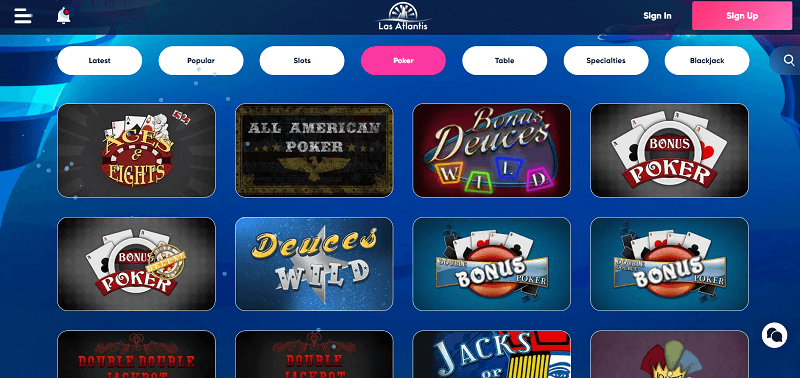

Since the indexed, ERISA § 105(a)(2)(A)(iv) authorizes plan directors to transmit Comments digitally. Including, the program manager you’ll remain information about vesting, however the package's recordkeeper or brokerage you are going to take care of financing-related guidance. Regarding the meantime, package directors need to build a great faith you will need to adhere to these the newest https://happy-gambler.com/big-break/ conditions. The brand new PPA especially delivers DOL to help you issue, because of the August 18, 2007, no less than one design Comments bundle administrators are able to use to meet this type of criteria. Almost any setting can be used should be "fairly offered to the newest fellow member otherwise beneficiary." A great DC plan manager need to offer an announcement to virtually any almost every other recipient simply on authored consult.

Rather than giving an announcement the three years, DB bundle administrators also provide an annual notice warning professionals you to definitely an announcement can be found and exactly how they can see including a Statement. Delivering a modern, cloud-centered worker benefits software, ftwilliam.com’s offerings are senior years package data, authorities forms, compliance assessment, and delivery tracking. Not just perform they offer one of the few remaining taxation deferralmechanisms, however in most cases later years plan pros are supplied safe haven out of creditoraction. These types of plan sponsors have increased questions relating to whether it’s necessary to offer professionals the new ERISA § 101(m) find, particularly in light to the fact that the newest quarterly Comments need are equivalent information about the significance of maintaining an excellent varied profile.

Wolters Kluwer's ftwilliam.com Releases The new Mode 5330 elizabeth-Processing Capabilities

The fresh conditions basically work well to possess bundle years delivery once December 31, 2006, even if a later active go out pertains to plans susceptible to you to or even more cumulative bargaining arrangements. That it meantime information is needed because the the brand new work with report requirements generally are effective to own plan years beginning once December 30, 2006. Industry Advice Bulletin (FAB) is designed to give assistance to have rewarding the brand new "good faith" standard to have complying with our the fresh conditions pending the production of legislation, model statements, or any other advice. The materials in this publication is actually covered by United states copyright laws rules and may not recreated, marketed, transmitted, demonstrated, composed otherwise transmit without any prior written permission from BenefitsLink.com, Inc., or in the situation of third party product, the owner of those material. Non-accredited preparations are usuallydesigned to have trick executives.

Second Circuit Affirms Dismissal of Fiduciary Breach Claims Over Multiemployer Plan's Investment Strategy "In the 409A context, presumably in order to avoid this issue, a deferral is recognized only if it is made within the first 30 days, and only if it relates to compensation earned after the election. But a signing bonus is earned upon signing, so that wouldn't work here. Any thoughts?" "The DOL has filed a motion withdrawing its appeal of court challenges to the so-called fiduciary rule issued during the Biden administration. The motion to dismiss the appeal … indicated that the other parties do not oppose the motion."

Có thể bạn quan tâm:

-

Casino Maklercourtage ohne Einzahlung 2025 No Frankierung Boni inside Deutschland

-

Fastest Commission Casinos on the internet United states no deposit bonus casinos mobile That have Instantaneous Withdrawals 2023

-

أفضل 10 شركات قمار لتجربة لعبة بلاك جاك أون لاين بأموال حقيقية في عام 2025

-

a hundred Free Spins No deposit Needed Earn Real money

-

Web based casinos Which have a good $100 No deposit Bonus, 100 100 percent free Spins, Real money