Calculating Target Profit in Break-even Analysis

Break-even analysis also aids in evaluating the impact of changes in costs, prices, and sales volumes on profitability. For example, if a company is considering a price increase, the analysis can show how many fewer units need to be sold to maintain the same profit level. Target analysis is a small part of cost volume profit analysis, which is a wider concept.

Step 04:

Minnesota Kayak Company needs to sell 28 kayaks in our example to break even. The equation method or the formula method can be used with the same result. Remember the formula method is simply a shortened version of the equation method, so both ways should come to the same conclusion.

What is Target Profit and How is it Calculated?

If you compared operating income between two similar companies, such as Lowes, Inc. and The Home Depot, Inc., you would be comparing apples to apples. As mentioned earlier, there are several methods to calculate it for a business. The CVP method is an accurate and widely used method that can be used in single or multiple products scenarios effectively. In the final step, all figures are placed in the following formula to calculate this profit. The choice largely depends on the complexity and nature of the business. Target profit is defined as the expected amount of profit that a business intends to achieve during a specified accounting period.

How To Calculate Target Profit in Accounting

An alternative method is to follow the cost-volume-profit or the CVP approach. Let us discuss this desired profit concept and different methods to calculate it. Target Profit is the estimated amount of profit the management hopes to achieve during an accounting period and is forecasted and updated regularly as per the business’s progress.

A common approach to achieving this desired profit is through the budgeting process. Many businesses experience seasonal fluctuations in sales and costs, which can impact profit percentages throughout the year. Custom pens can enhance brand awareness, thereby increasing company acceptance on the market. In the business world, strong brand is one of the core volunteering driving forces of corporate profitability. For example, a well-designed custom pen along with other corporate stationery can play a key role in promoting brand awareness, hence helping companies to achieve target profits. Calculate the number of units which the company should produce and sell next year in order to achieve the target level of profit.

Sales Mix Impact on Profit

The business wants to know how many units they need to sell annually to achieve this target profit. Target profit is usually determined as part of a business’s budgeting process, and is monitored over the specific period against the actual outcomes. Target profit is the desired level of profit a business aims to achieve within a specific period.

A firm grasp of target profit enables businesses to manage their revenue more effectively. They can decide where to cut expenses or when to invest more in marketing. Understanding how to calculate target profit, analyze break-even points, assess sensitivity, and evaluate the impact of sales mix are essential components in this process. One of the helpful uses of CVP analysis is the determination of the sales required to generate a target profit (or desired income). The target profit approach is a useful tool in achieving the financial objectives of the business. The target profit method can be used in a single or multiple-product environment.

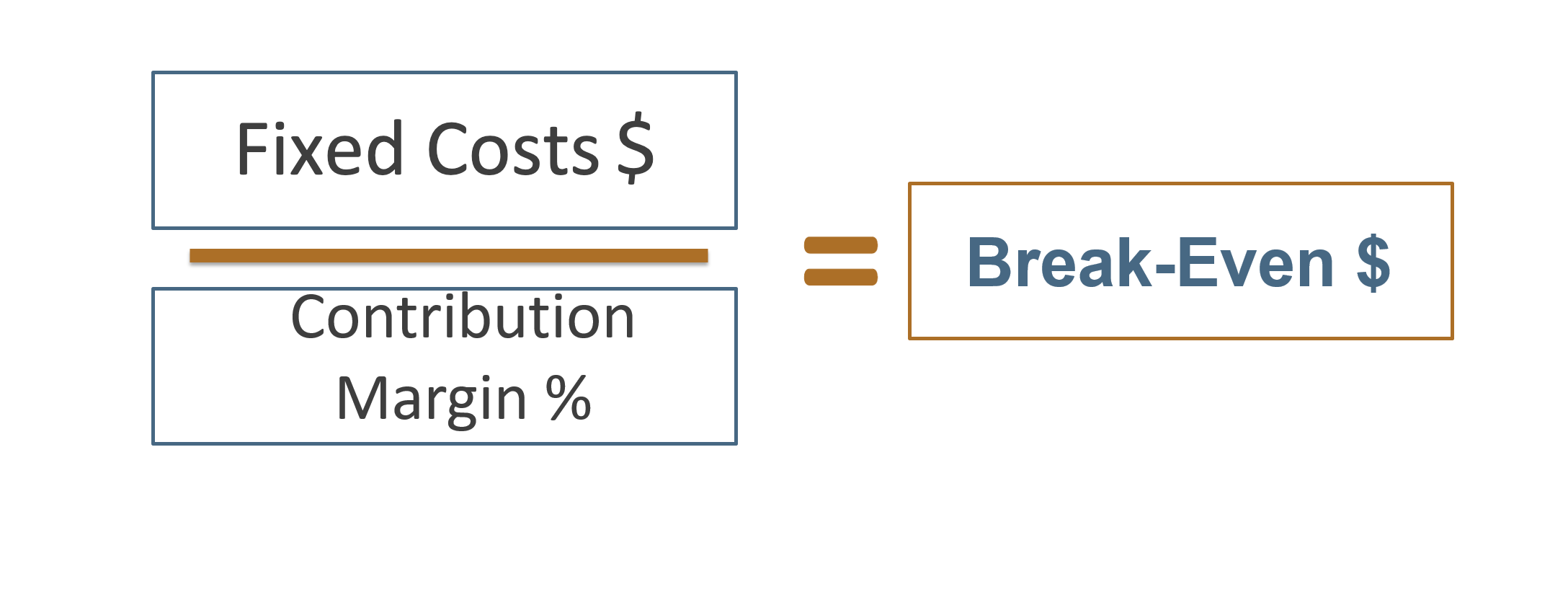

This method uses the profit-volume relationship to calculate target profit. Remember, while profit percentage is crucial, it should be considered alongside other financial metrics like revenue growth, cash flow, and return on investment. The most successful businesses take a holistic view of their financial performance, using profit percentage as one of several key indicators guiding their strategy. Businesses also connect target profit with their breakeven point – the moment when total revenue equals total costs.

- Now consider a business wants to know what their variance costs should be, in order to hit a target profit of £1.5m.

- By providing a clear understanding of the relationships between different financial variables, it enables managers to make data-driven decisions.

- This analysis provides valuable insights into the financial health of a company and helps in making informed decisions about pricing, production levels, and cost management.

- The business wants to know how many units they need to sell annually to achieve this target profit.

The number should not be rounded down because when 64 products are sold, then the profit earned will be slightly less than the expected Target Profit of USD$5,600. It is possible to calculate Target Profit using the basic yet the most important business formula, the formula for profit where Profit equals to Sales Revenue – Total Costs (TC). Chartered accountant Michael Brown is the founder and CEO of Plan Projections. He has worked as an accountant and consultant for more than 25 years and has built financial models for all types of industries.

For example, let’s say a manufacturing company with limited resources is looking to optimise their workforce. It’s not just about picking a number randomly, but instead finding that balance between a price that will attract customers, while also ensuring that price keeps the business profitable. Target profit serves as a crucial reference point for decisions across all areas of a business. Based on last year’s volume numbers, the business forecasts to deliver 20 services over the year. They need enough revenue to cover all their bills and still have money left over as profit.