Financial Showdown: Virtual assistant vs. Conventional compared to. FHA compared to. USDA A relative Picture

Deciding on the best financial normally somewhat effect your financial coming and you will homeownership experience. To help with so it vital decision, we now have gathered a relative investigation out-of Va Financing against almost every other popular financial sizes.

So it review aims to focus on key variations and you will similarities, delivering a very clear, to the level picture so you’re able to browse your options.

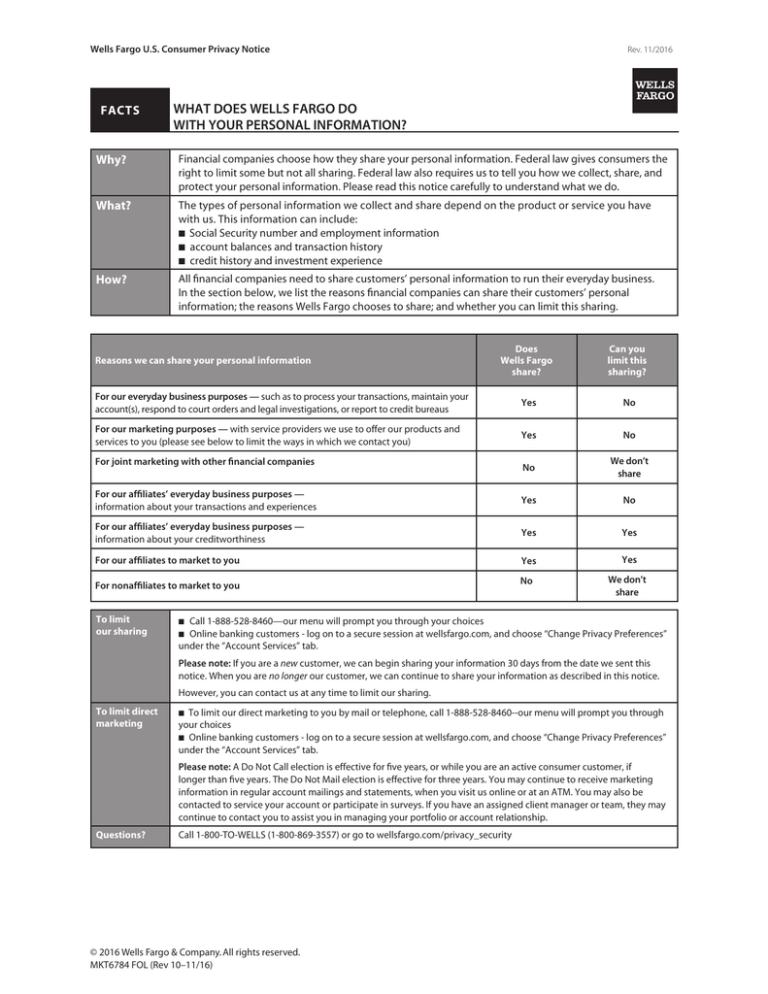

Below was a dining table that contours the essential items of any. Which graphic publication is made to express advanced advice, which makes it easier on precisely how to weigh the advantages and you can cons each and every home loan style of without delay.

Please note that the suggestions provided inside dining table is actually an excellent standard publication. Rates normally fluctuate based on markets requirements and you will personal lender formula, and you can qualification criteria could have additional criteria perhaps not completely seized right here. Understand the help guide to navigating latest financial rates to learn more.

It analysis acts as a starting point on the lookup, therefore we prompt that investigate for each alternative further, particularly when one to seems to line up along with your finances and homeownership goals.

Whether or not your really worth new zero downpayment element of Virtual assistant and you can USDA Finance, the flexibility of Conventional Finance, or even the access to from FHA Financing, discover a home loan alternative designed towards novel need and you can factors.

In-Breadth Evaluation

Now you have to visit a small deeper and you can speak about this type of home loan options. Let us peel right back the fresh layers each and every mortgage type of, exploring their special has actually, positives, and you can possible disadvantages.

All of our mission is to try to let you with a thorough understanding of easy personal loans to get how these types of funds differ used, besides written down, to help you take advantage told choice designed toward novel homebuying needs and you may monetary situations.

Virtual assistant Loans compared to Antique Loans

When choosing the best mortgage, understanding the secret differences when considering Va Finance and you may Conventional Financing is actually crucial for veterans and you may energetic military members. One another mortgage products give unique experts and you may factors tailored meet up with diverse economic issues and homeownership specifications.

Downpayment

One of several differences between Virtual assistant Fund and you will Traditional Money lies in the brand new advance payment requirements. Va Financing try celebrated because of their 0% down-payment work for, giving unparalleled entry to homeownership for these who’ve offered. Conversely, Traditional Funds generally wanted a down payment ranging from step three% to help you 20%, depending on the lender’s conditions and borrower’s creditworthiness.

Mortgage Insurance

Another type of important element is the dependence on mortgage insurance coverage. Virtual assistant Loans don’t require private home loan insurance (PMI), long lasting down-payment matter, that lead to reasonable month-to-month savings for you. Conventional Financing consumers, concurrently, need to pay PMI in the event that the down payment is actually less than 20% of your own home’s cost, incorporating an additional cost up until the loan-to-value ratio reaches 80%.

Rates

Interest rates getting Va Funds are below men and women having Conventional Loans, because of the government support. This can lead to straight down monthly payments and you can significant discounts more the life of your loan. Conventional Financing prices decided of the borrower’s credit history, downpayment, financing term, or any other products.

Borrowing from the bank Conditions

Va Financing are generally much more flexible which have credit criteria, making it possible for veterans and you can active military members that have straight down credit scores to still be eligible for a home loan. Conventional Funds, however, generally have more strict credit score criteria, commonly requiring a rating out of 620 or more getting recognition.

Mortgage Limitations

When you’re Virtual assistant Money once had limits predicated on condition guidance, changes in the past several years features eliminated loan limitations to have consumers that have full entitlement, enabling the financing away from homes at large rates items in the place of a downpayment. Old-fashioned Fund, although not, comply with mortgage restrictions place by the Federal Property Money Agencies (FHFA), that may vary by the state and are generally modified per year.